Gesatech Solutions

Your Trusted IT Partner

Fintech: The Future of Payments in Africa

- November 29, 2018

- Publications, Thought Leadership

The biggest hurdles to fintechs in Africa revolve around infrastructure. From poor road networks to limited housing address systems, entrepreneurs are limited in their ability to move goods from one side of the continent to another and accept payments in the comfort of their offices. The last decade, however, has seen tremendous changes. Mobile money transactions are growing. E-commerce is riding hard. Card payments are gaining traction and, for obvious reasons, the future of payments still remains in mobile devices.

Mobile Money

Mobile money or SMS payments are the most popular forms of payments across Africa. In Ghana, mobile money transactions have hit over a billion Ghana cedis this year as registered mobile money accounts outstripped the country’s population for the first time since its introduction a decade ago. With increased trust in mobile payments and increased smartphone (and feature phone) penetration, businesses have jumped on the bandwagon to use it as a payment option for rendering goods and services.

M-Pesa is the pioneer of mobile money technology in Africa. In 2016, the company, which is operated by Safaricom, earned over half a billion dollars in mobile revenues. The wide subscriber base that telcos have has put them ahead of traditional financial service providers like banks. Banks have a rigid registration process too, while only an ID card is needed to create a mobile money account. With brands like Tecno, Itel, etc., providing cheap feature phones, it has become easier for households to access financial services, making a mobile money account much more routine than a bank account.

For perspective, MTN mobile money has about 41 million registered users across 15 countries. Orange Money and Tigo Cash have 16 and 8 million respectively; they are available in 14 and 5 countries respectively. M-Pesa has about 30 million registered subscribers across 10 countries. On the other hand, Ecobank, Standard Bank, and Barclays Africa each have between 11 million and 15 million depositors across all the countries they operate in, while Equity Bank of Kenya has about 9.2 million customers across 6 East African countries.

The effects have been staggering as well. To date, nearly half of the country’s GDP has been processed through M-Pesa one way or the other. M-Pesa is so popular that banks are cutting down on the number of cash-dispensing ATMs across the country. M-Pesa is so pervasive in eastern Africa that one online store in particular has made it ‘legal tender’. All players on Sky.garden pay and are paid using M-Pesa.

A similar tale cuts across the sub region. In the West African market, mobile money accounts reached 104.5 million in 2017, with a transaction volume of $5.3 billion. There are now 13 times more mobile money agents than bank branches and ATMs across West Africa. In Nigeria, where there is a more fragmented market due to market regulations, a major mobile money provider, Paga, has over 18,000 agents. The independent mobile solutions provider has amassed over 10 million users in Africa’s most populous nation.

Cash on Delivery

Cash is still king in many African countries. Between a lack of trust in available systems and the limited reach that banking institutions have, majority of businesses are modeled on accepting cash. There is also a huge informal sector that is beyond the reach of modern infrastructure and services. Many of the persons in this sector do not have access to basic forms of identification or house addresses. For businesses serving this section of the public and for those operating within it, cash on delivery (CoD) has proven the only viable alternative so far.

This clear limitation hasn’t perturbed e-commerce players to brave this quagmire. E-commerce in Africa generated more than $17 billion in revenue in 2017. One of the largest contributors is Jumia Marketplace. Established in 2012 in Nigeria, Jumia has gone on to open national sites in Ghana, Kenya, Tanzania, Tunisia, Algeria, Cameroon, and Uganda and has collaborations with meQasa of Ghana and PropertyPro.ng of Nigeria.

In addition to card and mobile money payments, Jumia allows its clients to place orders and make cash payments on delivery. In many of such cases, mistrust in individual sellers, instead of a lack of mobile payment solution, could be the reason for opting for CoD.

E-wallets

E-wallets have become widespread across Africa. Where credit/debit cards have not been so popular, platforms like expressPay have integrated mobile money and bank account information to provide a one-stop shop for all manner of payments. Users are able to pay utility bills as well as tuition fees to keep their wards ins school. Recently, MoneyGram, a leader in the remittances industry, teamed up with Zeepay to provide money transfer services to up to 11.8 million people across Ghana. Such collaborations drive financial inclusion and help serve the unbanked communities in particularly rural settings of Africa.

Apart from money transfer services, e-wallets will continue to bolster the e-commerce sub-sector by providing accessible and affordable payment gateways for retailers and customers. Instant cash transfers coupled with agile courier services will provide jobs for the youth and help businesses across Africa increase turnover.

China, through Alipay and WeChat Pay are also providing payment solutions for businesses in the online space. Alipay signed an agreement with Nigeria’s CoralPay to offer payment solutions across different countries on the continent. It has also signed a partnership agreement with South African tourism company, City Sightseeing, to enable Chinese visitors use their Alipay accounts while visiting the country.

The Future is Mobile

47% of West Africans have access to mobile phones. Ecobank has seen this and partnered with MasterCard to bring the QR Masterpass to Africa. Instead of using a credit or debit card to make payments, the Masterpass allows users to scan a QR code on a merchant’s checkout or online store using a smartphone. The user then enters the value of the transaction and proceeds to make a quick and secure payment.

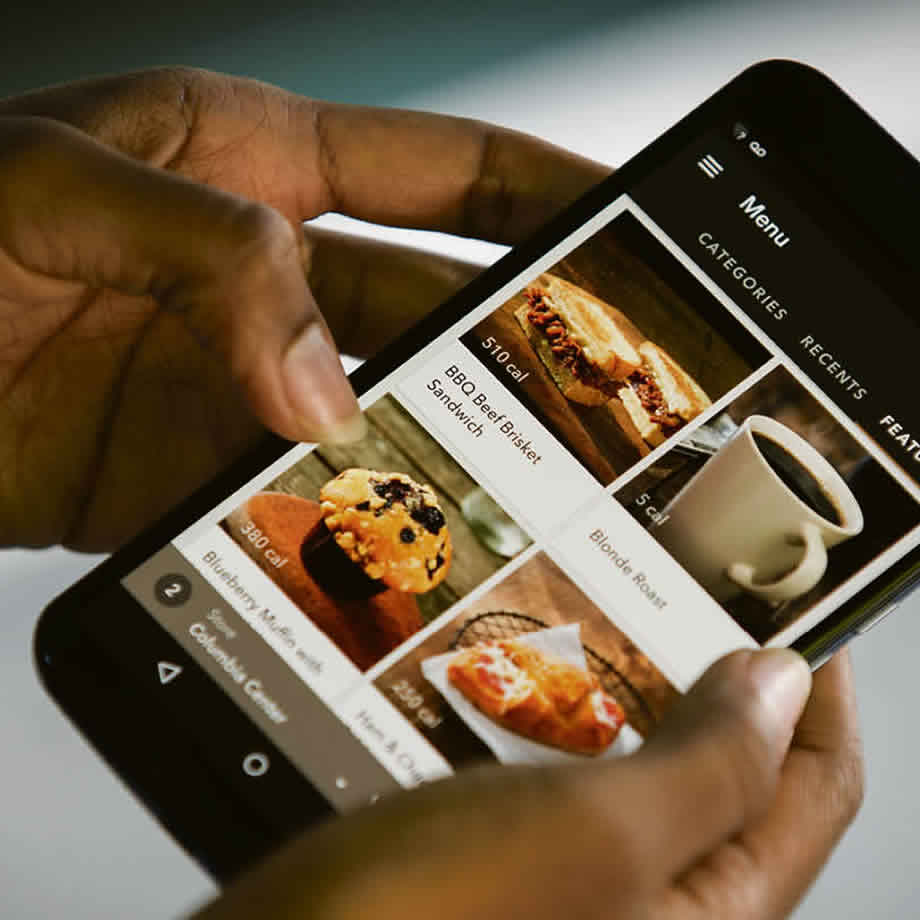

Globally and in Africa, payment service providers will have to innovate to cater for the needs of Generation Z. These are young people who have never known a world without Jumia, Apple, M-Pesa, Google, Uber, Amazon, or Facebook. They live on Instagram and communicate via WhatsApp. Half their lives is spent online and on their smartphones. After stepping into a banking hall to open a bank account the first time, they might never return, resorting instead to using their mobile banking apps. And, as this cohort of the exploding African population age and enter the labour force, payment service providers will have to match their offers to their respective needs.

This is where fintech businesses and traditional financial houses will have to work closely together. Banks are not designed to take on the level of risk that innovation demands. They measure and then manage the risks they expose depositor funds to. On the flip side, fintechs do not have the reputation nor the customer base that telcos and banks possess. But they are built to be more agile and creative in addressing the needs of clients. To move forward, behemoths like Safaricom and MTN will have to work with Ecobank, Barclays, and Equity on platforms created by third parties to create workable solutions for the youth.

Good UX & functionality are crucial

African entrepreneurs will still have to streamline the user interface of their many products to increase adoption, however. It is no longer a matter of just “pressing to pay” for online goods or services. Fintechs and their partners in the traditional financial space will have to follow the user along the journey, from recognizing a product in an online shop to sampling it and then delivering said product within record time. They have to be able to provide next-level services in how to manage and track expenses, predict the card with the lowest fees, and still keep responses safe and ready to use in the future. Without collaboration, bankers could become the biggest losers; fintechs have shown a daring capacity to innovate, and could soon create a platform that displays a customer’s checking and savings balances in a single window with a single click of a button.

Smart collaborations

An example of a smart deal is what Alipay and WeChat Pay signed with Singapore-based Red Dot Payment and Kenya’s Equity Bank. The deal will see the two Chinese payment apps leverage the clout of East Africa’s largest bank to reach up to 60% of the region’s e-commerce clients. Businesses and locals will be able to make payments and transfers in both local and international currencies. The partnership will be convenient for the growing Chinese population in the region as well as African businesses seeking to do business in China.

The mobile revolution soldiers on in Africa, and the businesses that are able to exploit its convenient usability will be the biggest winners. In Kenya, Pesapal is showing the way and has created a payment platform for small businesses across East Africa to accept payments from clients. Working with a mobile point of sale, Pesapal works directly with a mobile device to accept payments and issue instant receipts. Pesapal circumvents the interoperabilty costs of operating different mobile money accounts for different customers. With their platform, businesses are able to receive both local and international currencies in real time. Further innovation and integration with all major mobile money services across Africa would create a huge payments powerhouse that would bolster international trade on the continent.

Integrating near-field communication into mobile payments

Another area African businesses can exploit is the near-field communication (NFC) technology. NFC allows mobile devices in close proximity to exchange information. Apart from exchanging images and music files, NFC technology also makes it possible to make payment transactions. Currently, Apple Pay, Android Pay, and Samsung Pay are the giants using NFC technology to provide payment solutions.

For payment to go through, a buyer needs to hold the smart device inches away from the NFC-enabled reader. Between pulling out your smartphone and flashing it over the reader, the payment is initiated and done with in seconds. The speed with which information flows in NFC is a big deal. Even against EMV cards and the QR codes introduced by Ecobank, NFC is faster…and safer.

Marrying speed and safety

For the large informal sector in Africa, a quick transaction is as important as a safe transaction. A passenger could pay a bus conductor in Lagos by just flashing their phones to a mobile NFC reader, for example. After all, as innovation drives change in the fintech space, so too does it draw unwanted admirers among cybercriminals. The more information customers give up to fintechs and banking institutions, the more at risk customers are in case of security breaches. NFC technology does a remarkable job in this regard.

Magnetic stripe cards, for example, keep all information on the card the way the information is entered. NFC, on the other hand, keeps it dynamic. The encrypted information that is transferred during any two NFC transactions are never the same. Apple Pay, which is built on NFC, uses tokenization to store and transmit information values. This means any information accessed is only usable for the specific time period. If that information were to be stolen, it would be worthless to the hacker. This double security feature means hackers can’t clone user information either.

In conclusion…

For African businesses, mobile holds the key to payments solutions. Fintechs and banks need to work together to provide secured platforms to mitigate risks as innovation takes the centre stage. To increase penetration, payment solutions must have excellent user interfaces that provide more in fewer clicks. It’s an exciting future that awaits the continent, one with endless opportunities.

Share this article with your friends

MORE RESOURCES

Contact Details

No. 35/C16

Off Spintex Road

Opposite Global Access

Accra, Ghana

+233-(0)30 297 8297

+233-(0)55 846 8325

Copyright 2017 © Gesatech Solutions